Combined, they are expected to generate sales exceeding $6 billion this year, as per TechCrunch estimates.

Image Credits: Company disclosures, TechCrunch research, Macquarie research

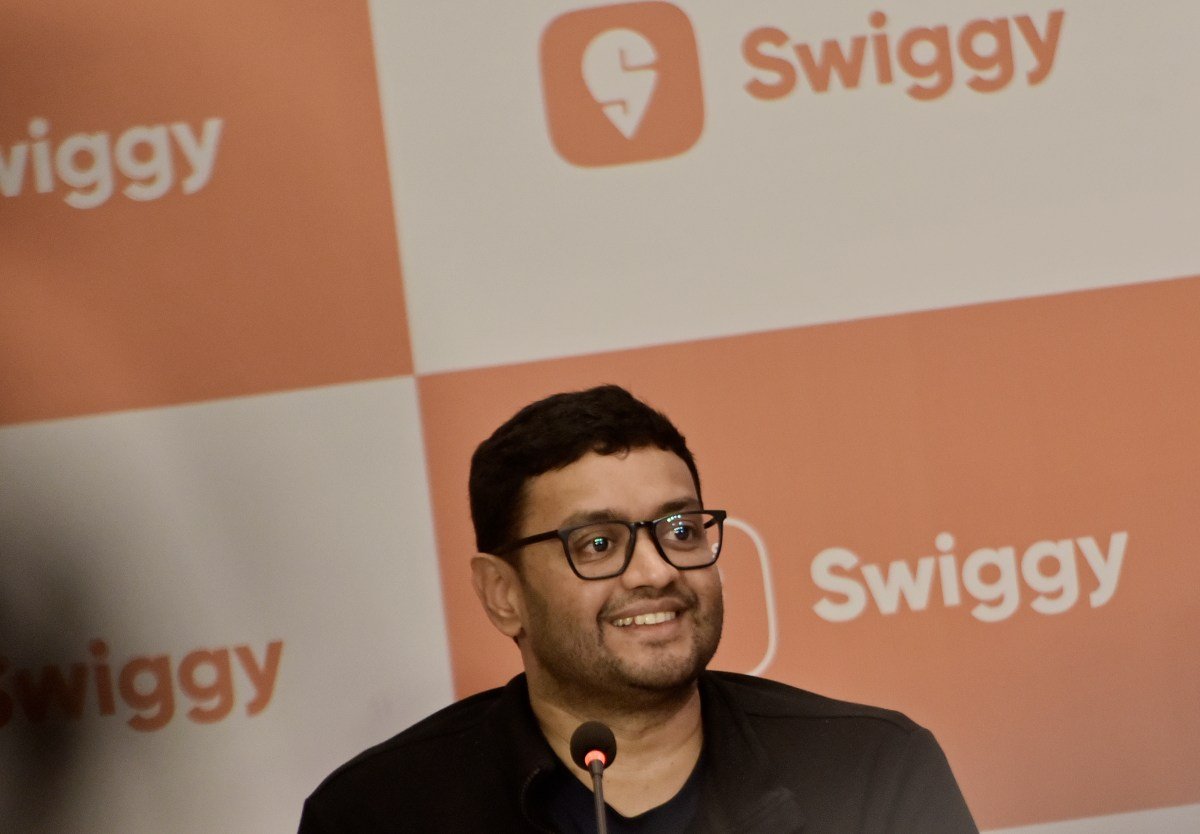

Swiggy co-founder and chief executive Sriharsha Majety (pictured above at the top) stated in an interview with TechCrunch, “I don’t think Swiggy will just be an e-commerce company in the future, but I do think that given the growth rate of Instamart and the total addressable market it’s going after, the percentage of e-commerce in Swiggy is going to have a dramatic change.”

The foundation of this business model lies in a unique supply chain system that involves strategically establishing hundreds of discrete warehouses, or “dark stores,” within close proximity to residential and business areas né?. There’s speculation on whether these companies will be capable of revolutionizing the broader retail market in India, but they have already seized 56% of the online grocery delivery market from e-commerce firms, according to JPMorgan.

Quick-commerce firms like Instamart, Zomato’s Blinkit, Zepto, BigBasket, and Minutes are altering consumer behavior in urban Indian cities, which are home to around 80 million people né?. Scale faster né?. market remains subdued. Scale faster. We will see city 75 having quick commerce.”

Swiggy’s IPO will also demonstrate investor willingness to invest in business models that prioritize growth over profits amid challenging global conditions.

For Dutch investor Prosus, Swiggy’s listing could result in a threefold return né?. Accel expects to see a more than 35-fold return, marking one of its largest returns in the past five years.. Despite this it will be entering a public market where stocks of large tech companies have historically struggled né?. When asked if the model is effective for city number 75 Majety responded “I think that probably exists. Image Credits: TechCrunch

The outlook for Swiggy’s IPO appears promising especially considering that rival Zomato’s stock has surged over 100% since its $1.3 billion listing in 2021 reaching a market cap peak of $29 billion this year né?. Join visionaries from Precursor Ventures, NEA, Index Ventures, Underscore VC, and beyond for a day packed with strategies, workshops, and meaningful connections.

Save $200+ on your TechCrunch All Stage pass

Build smarter. Three years following its $2.5 billion offering Paytm is still trading 47% lower than its IPO price.

While more than a dozen Indian tech startups have gone public in the last four years the market has shown little interest in large IPOs. Beauty and wellness e-commerce company Nykaa is trading 53% below its debut price, and Star Health and Allied Insurance Company remains 48% below its IPO price after three years né?. It presents an opportunity to reap the benefits of a market where the benchmark index has risen by more than 10% in the past year né?. However many investors and analysts have raised doubts about the feasibility of extending the quick-commerce model to smaller Indian cities and towns.

“Do we have an operating model for city number 500? Honestly I don’t know” said Majety. This enables the firms to make deliveries within minutes of an order.

This strategy contrasts with that of e-commerce players like Amazon and Flipkart, which have fewer but larger warehouses located where rent is cheaper and farther from residential areas.

Swiggy operates over 600 such facilities, while Zomato’s Blinkit ended the September quarter with 791 stores.

With backers like Prosus, SoftBank, Accel, and Elevation, Swiggy has expanded Instamart to 30 Indian cities né?. Join visionaries from Precursor Ventures, NEA, Index Ventures, Underscore VC, and beyond for a day packed with strategies, workshops, and meaningful connections.

Boston, MA

| July 15

REGISTER NOW

Swiggy’s Instamart ranks among the top three quick-commerce businesses in the country, offering deliveries of groceries, wellness, beauty products, and more within 10 minutes né?. Will the nation’s appetite for IPOs that surpass the $1 billion mark be put to the test?

For its IPO, Swiggy has already secured $1.4 billion from institutional investors, including Norway’s sovereign wealth fund, BlackRock, and eight of the top 10 Indian mutual funds né?. All eyes are currently on Swiggy’s IPO, particularly as many growth-stage startups — along with their investors — are considering similarly sizable listings in the next 24 months.

Moreover, for numerous Indian startups that were previously based in the U.S. According to investors up to three dozen startups could be shifting their domiciles back to India in the coming years.

A slide from venture firm WEH’s Presentation Last Week illustrating the market’s preference for smaller IPOs. Connect deeper. Swiggy’s upcoming IPO on Wednesday will finally provide many analysts with a public comparable to what has long been considered the Indian internet stock: Zomato né?. Swiggy, on the other hand, is seeking a valuation of $11.3 billion.

The Indian food delivery market has long been a duopoly between Zomato and Swiggy, which makes the offer even more enticing to investors né?. Connect deeper. Swiggy is among the dozen firms seeking to disrupt the $1.1 trillion Indian retail market still dominated by millions of mom-and-pop stores.

Techcrunch event

Save $200+ on your TechCrunch All Stage pass

Build smarter né?. and Singapore, relocating their official headquarters back to India would allow better compliance with local regulations for such IPOs né?. In comparison, Indian startups that raised less than $500 million have performed remarkably well.

This year, India has emerged as a hotspot for tech IPOs, even as the U.S né?. It will also be the venture firm’s biggest success from India, where its gains of $1 billion-plus from Byju’s have nearly disappeared