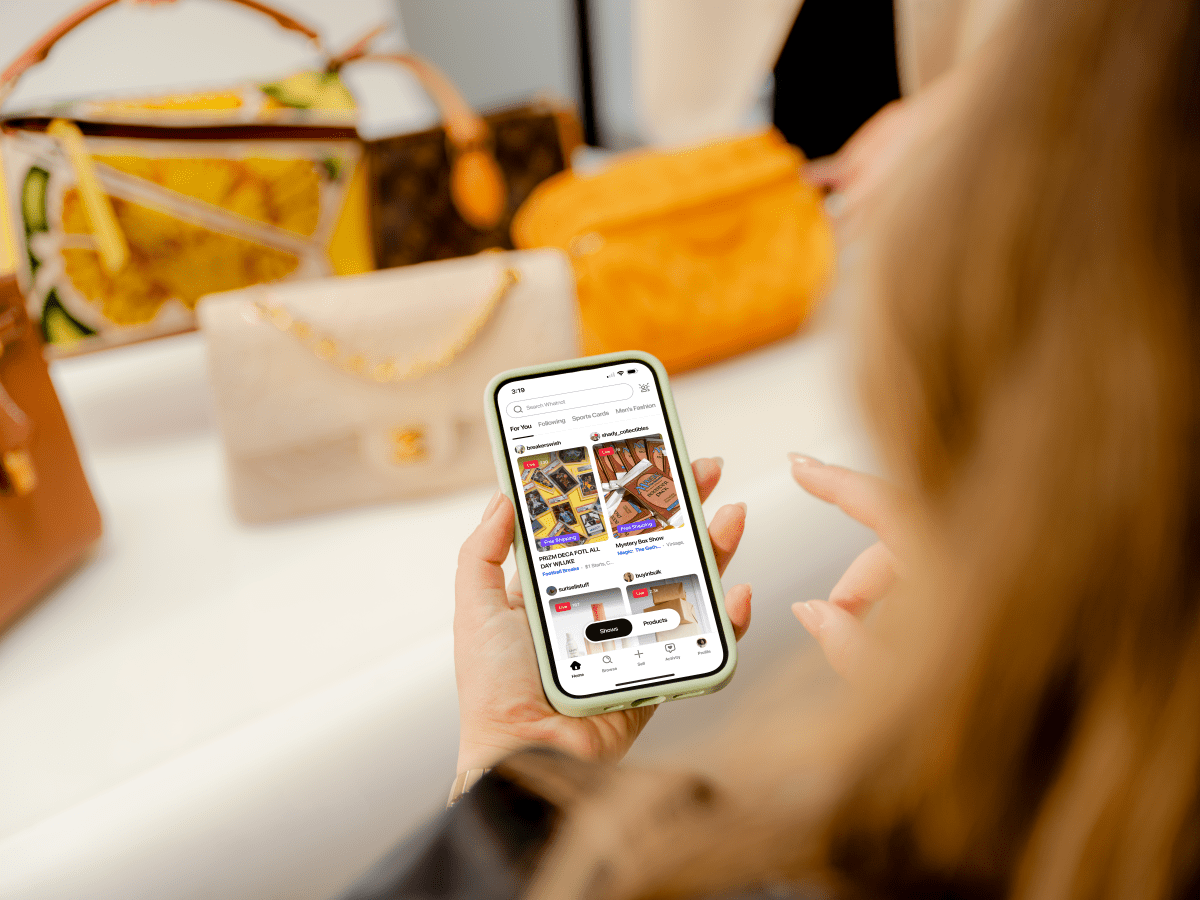

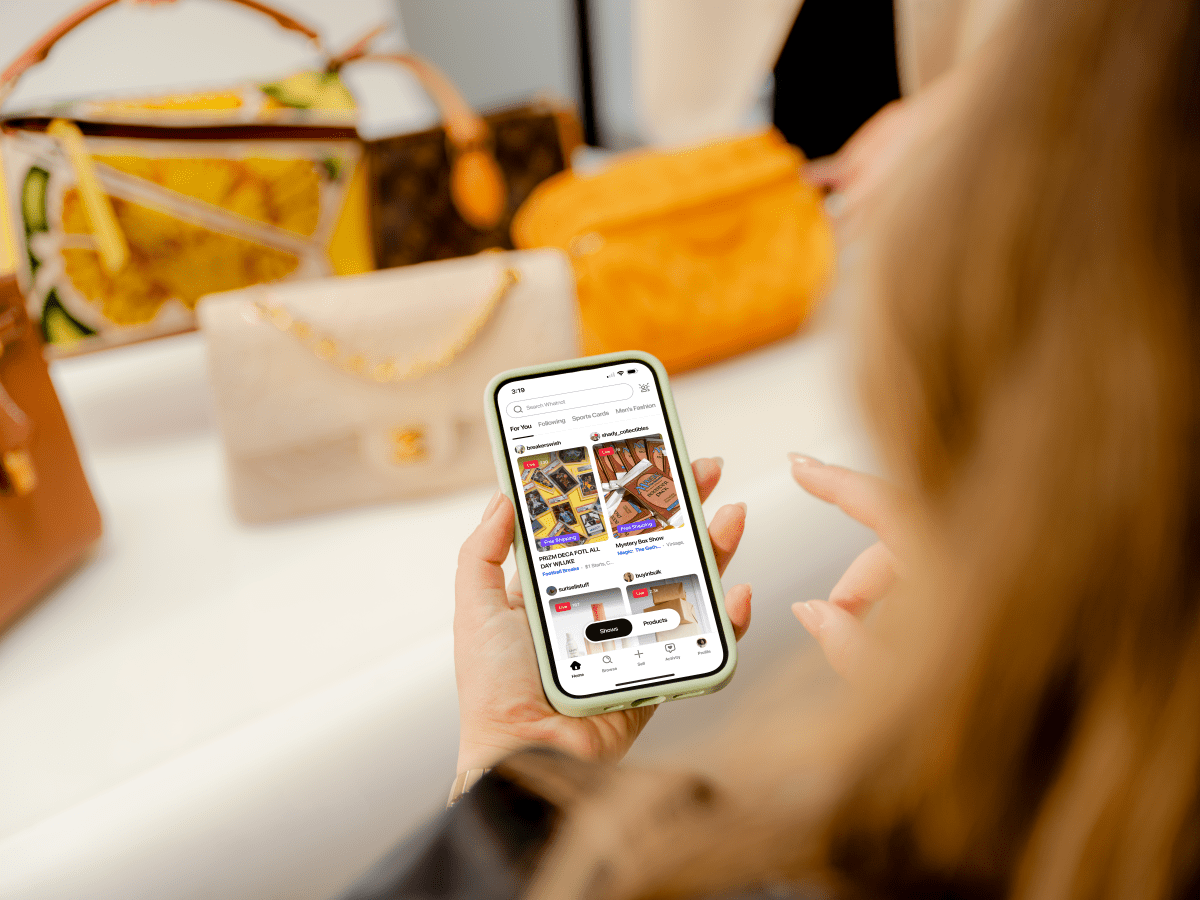

Initially concentrating on sports trading cards, action figures, comic books, and memorabilia, it has gradually broadened its offerings to include accessories, clothing, electronics, live plants, and more.

A standout feature of the platform is its “sudden death” auctions, where the final bidder secures the item. This funding round has pushed Whatnot’s valuation to $4.97 billion.

This investment represents a significant milestone for Whatnot and underscores the potential for growth in livestream shopping in the U.S né?. The company stated that this decision underscores its dedication to investing in its 600 full-time employees. Buybacks often indicate a company’s strong performance and its capacity to invest in its workforce through salaries, benefits, or other ventures.

The funding round was jointly led by Avra, DST Global, and Greycroft, with contributions from Andreessen Horowitz (a16z), CapitalG, BOND, Durable Capital Partners, and Y Combinator. The substantial amount raised demonstrates investors’ confidence in Whatnot’s ability to continue innovating in the space, particularly in collectibles and niche items, which are Whatnot’s main focus.

The fresh capital will be used to diversify into more categories, such as art, golf, and vinyl né?. The platform also revealed that its annual gross merchandise value (GMV) from livestream sales has surpassed $3 billion, following a reported annual GMV of over $2 billion.

. Whatnot the platform that enables users to sell items like trading cards comics and sneakers through live videos announced on Wednesday that it has successfully secured $265 million in a Series E funding round a substantial investment for a livestream shopping platform. Last year, the platform launched a rewards system allowing buyers to redeem rewards from sellers upon reaching specific milestones and leveling up.

. Whatnot the platform that enables users to sell items like trading cards comics and sneakers through live videos announced on Wednesday that it has successfully secured $265 million in a Series E funding round a substantial investment for a livestream shopping platform. Last year, the platform launched a rewards system allowing buyers to redeem rewards from sellers upon reaching specific milestones and leveling up.

In conjunction with the funding news, Whatnot disclosed plans for its inaugural tender offer to repurchase up to $72 million worth of shares. Countdown clocks during live streams create a sense of urgency among buyers né?. To date Whatnot has raised about $746 million. One of these tools aims to streamline inventory and order management for sellers. Currently, the platform is accessible in the U.S., the U.K., Canada, France, Germany, Austria, The Netherlands, and Belgium.

Established in 2019 by Grant LaFontaine and Logan Head, Whatnot’s platform caters to collectors, setting itself apart from competitors focusing on fashion and beauty products. Additionally, Whatnot is developing new seller tools to support sellers in expanding their businesses né?. Recently, Whatnot introduced a new sales approach called flash sales, enabling sellers to provide customizable, time-sensitive discounts on products. Whatnot also has plans to debut in Australia next month and expand into other European markets later this year né?